- 1800 171 329

- Mon - Fri 9:00 - 17:30

- 1-3 King St, Rockdale NSW 2216

- Home

- Refinancing Your Home Loan: When It Makes Sense (and When It Doesn’t)

Refinancing Your Home Loan: When It Makes Sense (and When It Doesn’t)

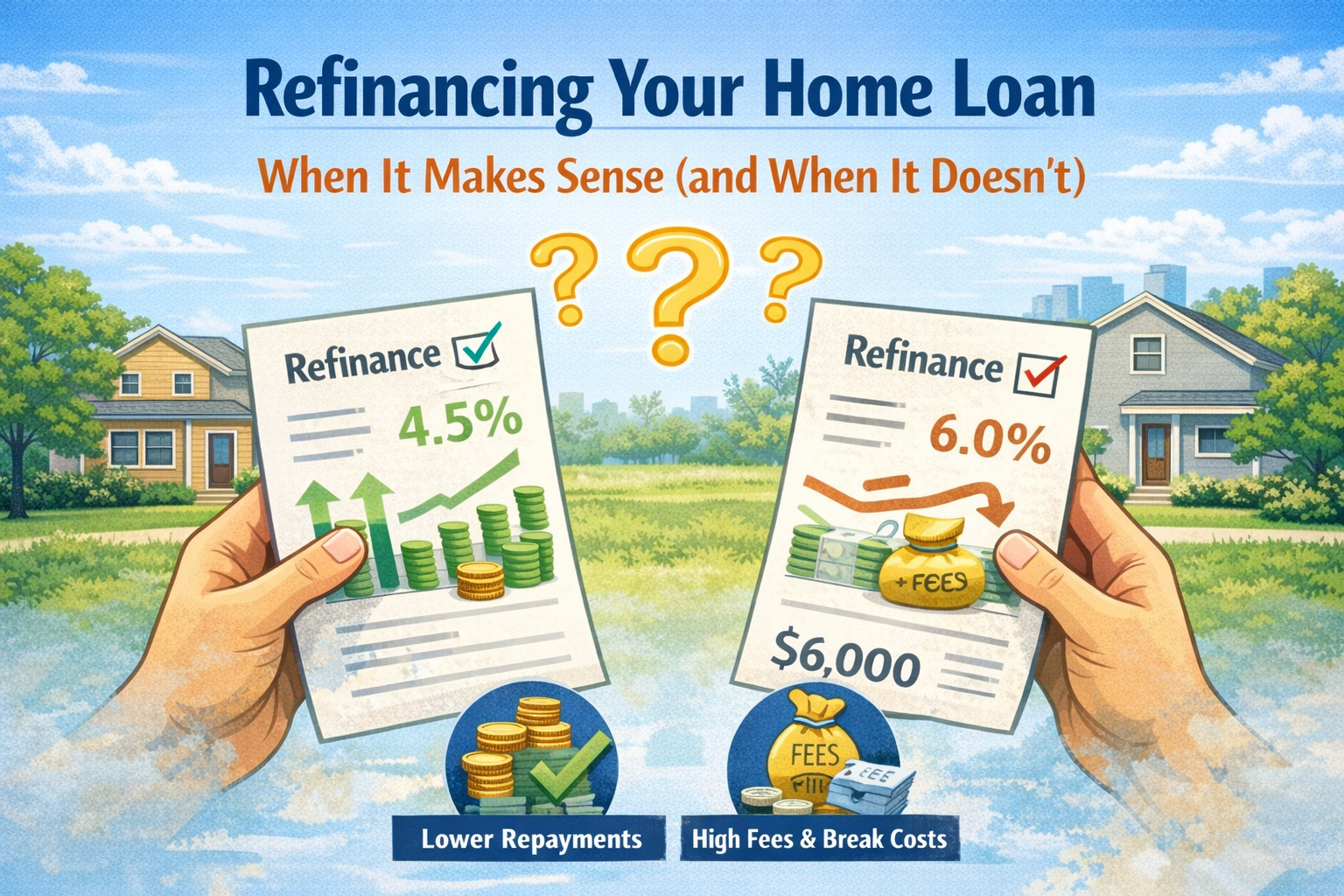

Refinancing your home loan can be a smart financial strategy, but it isn’t always the right choice. While it may help lower your interest rate, reduce repayments, or unlock equity, refinancing can also involve costs and risks if done at the wrong time. Knowing when refinancing is beneficial—and when it’s not—is key to making an informed decision.

Our Services

- KBA Home Loans

- No comment

- December 19, 2025

Refinancing your home loan can be a powerful financial move—but it isn’t always the right one. While refinancing can help you secure a lower interest rate, reduce repayments or access equity, it can also come with costs and risks if done at the wrong time. Understanding when refinancing makes sense and when it doesn’t is essential before making a decision.

What Does It Mean to Refinance a Home Loan?

Refinancing involves replacing your current home loan with a new one, either with your existing lender or a different lender. The new loan pays out your old loan and establishes new terms, which may include a different interest rate, loan type, repayment structure or loan length. Many borrowers refinance to improve their financial position, but the benefits depend on your individual circumstances.

When Refinancing Your Home Loan Makes Sense

Refinancing often makes sense when interest rates have fallen since you took out your original loan. Even a small reduction in your rate can lead to significant savings over time, particularly on larger loan balances. Lower rates can reduce your monthly repayments or allow you to pay off your loan faster.

It can also be a smart option if your financial situation has improved. An increase in income, reduced debts or improved credit history may allow you to qualify for better loan products with more competitive rates and features than those available when you first borrowed.

Refinancing may be beneficial if you want to access equity in your property. As your property value increases and your loan balance decreases, you may be able to borrow against that equity for purposes such as renovations, investments or consolidating higher-interest debts. When done carefully, this can improve cash flow or help you achieve long-term financial goals.

Another common reason to refinance is to change loan features. You may want to switch from a variable loan to a fixed rate for repayment certainty, move from a fixed loan to a variable to take advantage of extra repayments, or restructure your loan to include an offset account or redraw facility.

When Refinancing May Not Be the Right Choice

Refinancing may not make sense if the costs outweigh the benefits. These costs can include discharge fees, application fees, valuation fees and, in the case of fixed loans, significant break costs. If you’re only planning to stay in the property or keep the loan for a short time, the savings from refinancing may not justify these expenses.

If you’re nearing the end of your loan term, refinancing may also be less effective. At this stage, most of your repayments go toward the principal rather than interest, meaning a lower rate may not result in meaningful savings.

Refinancing can also be unsuitable if your financial situation has deteriorated. Reduced income, increased debts or a weaker credit profile may limit your options or result in less competitive loan offers than your existing loan.

Additionally, extending your loan term to lower repayments may cost more in the long run. While lower monthly payments can improve short-term cash flow, a longer loan term can significantly increase the total interest paid over time.

Common Refinancing Mistakes to Avoid

One of the most common mistakes borrowers make is focusing solely on interest rates without considering fees, features and long-term costs. Another is increasing their loan balance through cash-out refinancing without a clear purpose or repayment strategy. Making major financial changes, such as changing jobs or taking on new debts, during the refinancing process can also negatively impact approval.

How a Mortgage Broker Can Help With Refinancing

A mortgage broker can assess whether refinancing is genuinely beneficial based on your goals, financial position and the current lending environment. Brokers compare multiple lenders, calculate true savings after costs, explain break fees and help structure the loan correctly. Importantly, brokers are required to act in your best interests, ensuring refinancing aligns with your long-term financial goals rather than just offering a lower headline rate.

Is Refinancing Right for You?

Refinancing your home loan can be a smart move when it aligns with your financial goals and results in real savings or improved flexibility. However, it’s not a one-size-fits-all solution. Understanding both the advantages and potential drawbacks is key to making an informed decision.

If you’re considering refinancing, seeking professional advice can help you determine whether it makes sense now—or whether you’re better off staying with your current loan.